Last week a number of the world’s most important central banks met to discuss their respective monetary policies amid the appearance of the fast spreading Omicron variant of Covid -19. It was interesting to see how markets reacted to the comments which emerged from these meetings.

The Federal reserve signalled a doubling of the rate of its tapering of QE, and forecast that US rates would increase in 2022 and beyond.

The closely watched ‘dot plot’ has steepened significantly since the September meeting with more members forecasting earlier rate increases.

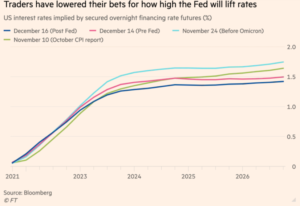

Despite the Fed’s hawkish tone, markets did not fully agree with the central bank’s outlook, and forward rates fell slightly, with a peak of 1.5% being expected as opposed to the Fed’s predictions of 2.5%.

In the UK, the Bank of England surprised markets for a second MPC meeting in a row. November’s meeting was expected to announce a base rate increase but didn’t, whilst December’s meeting was not expected to announce a hike, but did!

Both the Fed and BOE decisions were, to a large extent, the result of the respective increases in inflation that had been annonced earlier in the week. The UK CPI rose to 5.1% and the US rate 6.8% in the 12 months to November.

The BOE move was significant because it marks the beginning of a tightening cycle that is currently forecast to see rates reach 1.25% in 2022. The expectation of the MPC (that the Omicron strain won’t shut down the economy to the same extent that the Delta variant did) is a big one. The move, which compared to the rate of inflation itself is small, is significant however because it shows that the BOE is prepared to use monetary policy to control inflation.

The fact that the some of main drivers of inflation in the UK such as higher energy prices and supply shortages can’t be fixed by monetary policy has been a point of discussion, however the tightness of the labour market, a factor of Brexit, which is driving up wages needs to be controlled. Central bankers believe consumers behaviour can still be controlled with monetary policy and that making debt more expensive will reign in spending and reduce the reduce demand for goods ultimately cooling demand.

The tone of the ECB’s meeting last week contrasted with those of the UK and US. While there was a recognition that there was inflation in the Eurozone, the ECB president Christine Lagarde’s message was that it will dissipate and that conditions still do not exist for a tightening of rates in 2022. This view is not held by all policy makers, however, with Jens Weidmann, President of the Deutsche Bundesbank, arguing that the current rate of inflation needs to be confronted earlier that current ECB policy dictates.

After such a prolonged period of stagnation, times are suddenly interesting in rate world. The disappearance of Libor reference rates will add to the opaqueness of the value of term money, and banks appetite for funds will remain a driver in the level of their quoted rates.

The global interest rate cycle is turning up. The length of the upturn will be uncertain while the world’s economies deal with the impact of Covid and how this affects growth, however significant inflation, absent for so long, is suddenly out of the bottle.

The next year will be a fascinating blend of geopolitics, inflation, growth and asset allocation. At this time in 2020, the UK was facing the prospect of negative rates. We are now preparing for a year of tightening. Trying to guess how the world will look in 12 months from here has rarely been more difficult.

J O’Keeffe 20th December 2021