In the first in a new regular series, Jersey-based asset investment managers TEAM plc take a look at what’s happening on the markets.

THE past week saw one of the weak-est seven-day periods for markets for some time, with most major stock indices falling between 2% and 3.5%.

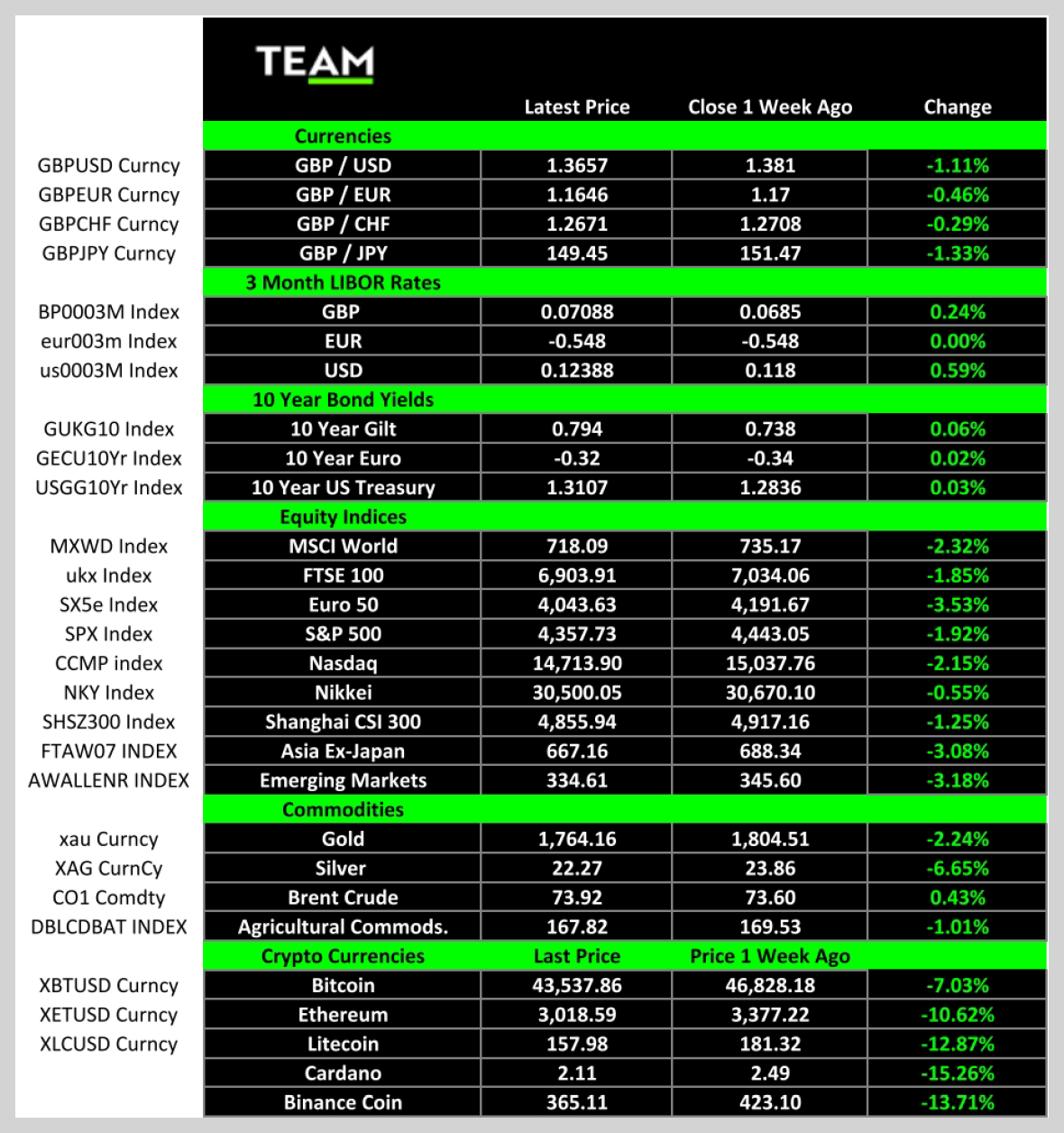

Japanese equities were the best performing sector, the Nikkei 225 Index falling by only 0.55%.

Excluding Japan, Asian markets saw large declines, driven by concerns over increasing Chinese regulatory intervention, and the suspension of interest payments on the debt of Evergrande, one of the country’s largest property development companies.

With at least 80 USD$ million in interest payments being due this week alone, the company faces a liquidity crunch.

While most of its business interests are centred in mainland China, its de-fault is causing global concerns, given that much of the debt is denominated in US Dollars, reflecting the inter-connected nature of modern glob-al financing arrangements (and the international nature of losses when they occur).

Cash and fixed-interest markets have seen a quieter period, 10 Year Gilt yields rising by six basis points, US Treasury yields by two basis points, while 10 Year Funds tightened a little, to -0.32%.

LIBOR rates were also largely un-changed, with three-month Sterling at 0.07%, US Dollars at 0.12% and EUR -0.55%.

Evidence of the continued rise in inflationary pressure being seen across most Western economies was seen in CPI data from both the UK and US during the week.

Inflation at the end of August in the UK came in at 4.8%, the highest monthly rate since 2011, while US CPI remains equally elevated at 5.3%.

Sterling was weaker across the board on the news, closing the period 1.3% weaker against the US Dollar and 0.6% weaker against the Euro.

Commodity prices were mixed, with gold down by around 2%, while oil prices climbed by 0.4%. Crypto-currency markets continued their wild ride of late, riled by rumours of increasing regulatory oversight by both Western and Chinese governments.

Bitcoin fell by 7%, while the other major coins fell by between 10% and 15%.

(Prices are as of close 20 September.)